China Evaluates Partnership With Russia

Publication: Eurasia Daily Monitor Volume: 21 Issue: 69

By:

Executive Summary:

- Russian President Vladimir Putin plans to make China the first foreign trip of his new presidential term, signaling his need to reaffirm the strategic partnership.

- Russia is closely monitoring US-China and EU-China dialogues ahead of the Ukraine peace summit in July, to which Beijing has not yet said whether it will send a delegation.

- Expanded EU and US willingness to take up measures against Chinese interests for China’s involvement with Russia could push Beijing to operate more cautiously with Moscow.

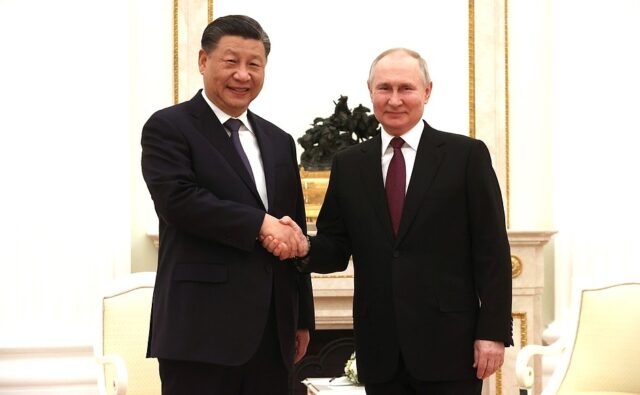

Russian President Vladimir Putin plans to visit China for the first foreign trip of his new presidential term, which begins on May 7 (TASS, May 2). This represents a pivot from 2018, when Vienna was Putin’s first destination, and 2012, when he visited Belarus, Germany, and France before China. Chinese Communist Party General Secretary Xi Jinping, however, made a point of traveling to Russia first after the start of his terms in 2013 and 2023, and Putin feels obliged to reciprocate. The visit is certain to be long on ceremony and mutual reassurances of the countries’ blossoming friendship, but how productive Putin’s kowtow will be is uncertain.

The first issue the Russian leader will likely address is financial transactions. In recent months, payment problems have developed from a minor irritation into a major headache (The Moscow Times, May 2). Many Chinese banks refuse to accept payments from Russia. The move has started to affect Chinese exports to Russia, which, in March, were 16 percent lower than the previous year (Forbes.ru, April 17). The import of Chinese machine tools is crucial to the overextended Russian defense industry, and Putin assumes that a small nod to Xi will resolve the situation (see EDM, January 22, May 6; RBC.ru, April 23; IStories media, April 17).

Moscow is growing wary of China’s relationship with Europe. Russian commentators were eager to scorn the mercantilist agenda of German Chancellor Olaf Scholz’s recent visit to Beijing. Now, they have begun to comment on the meeting between Scholz and French President Emmanuel Macron on May 2, just days before Xi’s state visit to France (Gazeta.ru, April 17; RIA Novosti, May 2). Some observers assert that, for China, exports to Russia, which amount to about 3 percent of Beijing’s total volume, are far less important than trade with the European Union (Kommersant, May 2). For Moscow, minor fluctuations in the global oil market remain of great importance, and the fact that China is advancing its agenda of curtailing hydrocarbon consumption does not quite fit into this petro-fueled perspective (Oilcapital.ru, April 30).

The course of US-China talks may perhaps perturb the Kremlin even more. The Kremlin closely monitored US Secretary of State Antony Blinken’s recent visit to Beijing and portrayed the trip as unsuccessful (Izvestiya, April 27). While Russia is concerned about the steady tightening of the sanctions regime, China’s professed readiness to manage and moderate its competition with the United States is an even greater concern. Such a development would leave Moscow without a crucial partner in its confrontation with the West (Kommersant, April 14). Far from joining Russia to push back in the UN, for example, Beijing reverted to past form in letting Moscow take the heat. In April, for instance, Russia used its veto power on the UN Security Council to block a US-Japan proposal to prevent a nuclear arms race in space. China opted to abstain (Nezavisimaya gazeta, May 3). Similarly, Russia blocked the extension of a UN mandate that granted an expert panel the ability to verify the implementation of sanctions in North Korea, and China abstained (Interfax, March 29).

Moscow experts seek to conceptualize the world order as a triangle shaped by interactions between Russia, the United States, and China. They struggle, however, to offer any substantial justification for the Kremlin’s claim to such a prominent role (Globalaffaits.ru, May 1). Beijing sees the economic and technological deterioration of its strategic partner as a source of weakness in managing global problems (RIAC, April 17). China takes particular pride in its capacity to send a scientific mission to the moon, while Russia’s space program steadily degrades and relies on antiquated technologies and parts (RIAC, April 23; Meduza.io, May 3; see EDM, May 6). The growing cooperation between Moscow and Pyongyang is based on their similar maverick and disruptive international behavior. North Korean leader Kim Jong Un’s recent directive to prepare for war “as never before” is perfectly fine for Putin, but such saber-rattling does not suit Xi (Rossiyskaya gazeta, April 11).

China is keen to criticize US dominance in the world order and its policy of strengthening alliances in the Indo-Pacific region, but some in Beijing feel that Russia’s hope to break this order–rather than replace it–is a dangerous overreach (TopWar.ru, April 29). The war in Ukraine constitutes a difficult test for Chinese revisionism, which emphasizes the centrality of state sovereignty and promotes geo-economics, as Blinken was reminded (BFM.ru, April 26). His reiteration of Western commitment to ensure Ukraine’s victory does not contradict this “principled” Chinese discourse, though the prospect of Russia’s defeat is disagreeable for Beijing (Kommersant, April 23). China’s supply of crucial material for the Russian defense industry is aimed at preventing such an outcome, but it does not necessarily mean that Beijing subscribes to Putin’s narrative of Russia’s firm control throughout the war.

The contradictions in Beijing’s stance create space for political maneuvering. China is currently attempting to thread the needle as it mulls over the role it might play in July at the Ukraine peace summit in Switzerland (Kommersant, May 2). The summit plans to discuss Ukrainian President Volodymyr Zelenskyy’s peace formula, which is premised on the withdrawal of all Russian forces from Ukraine’s territory, including Crimea. It is critical for Putin to dissuade Xi from sending any representatives to the event (Vedomosti, May 2). The Chinese leader, however, prefers to keep his options open. During his tour of Europe this week—the first in five years—Xi probably will seek to determine whether Macron is serious about sending North Atlantic Treaty Organization (NATO) troops to Ukraine (Izvestiya, May 5).

China’s absence from the forum that could mark the beginning of the end of the war is hardly an attractive choice for Beijing. Xi can certainly make Putin an offer to end the hostilities, but the Chinese leader cannot be sure that the timing is right for such a forceful initiative. In the larger picture, Russia’s frontal attacks on Chasiv Yar may not even register for China, but the expansion of defense production in the European Union and the United States certainly does. The tide of the war has shifted several times over its 800 days, and the Chinese leadership may feel that it is set to change again with the recommitment of Western support to Ukraine.